Amire Comfort M.1,

E. O. Omoare2

1Crawford University Igbesa, Ogun State, Nigeria

2Ogun State Institute of Technology (OGITECH) Igbesa, Ogun State, Nigeria

Correspondence to: Amire Comfort M., Crawford University Igbesa, Ogun State, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Abstract

Economic activities can be described as legal

activities that create and distribute utility from points of production

to places of final consumption at a price. Economic activities have been

classified into productive activities, commercial activities,

distributive activities and service activities. Economic activities are

embarked on by two separate economic agents identified as suppliers and

buyers. The advent of money resulted into growth and development in

economic activities. However, negative consequences associated with

cash-based transactions necessitated the adoption of cashless policy.

The cashless policy is a policy that encourages more electronic-based

transactions. The aim of this study is to determine how some factors of

cashless policy impact on economic activities. Some of these factors are

availability of power, infrastructures and literacy level. Findings

revealed that cashless policy has contributed to the promotion of

technology enhanced businesses. In addition, constant and regular supply

of electricity will aid cashless policy, thereby strengthening economic

activities in Developing countries.

Keywords:

Cashless policy, Economic activities., Cash-based economy, Electronic-based transactions

Cite this paper: Amire Comfort M., E. O. Omoare, Cashless Policy and Economic Activities in Developing Countries (A Case Study of Nigeria),

American Journal of Economics, Vol. 5 No. 4, 2015, pp. 417-422. doi: 10.5923/j.economics.20150504.03.

1. Introduction

2. Objectives of the Study

3. Review of Literature and Theoretical Framework

4. Methodology

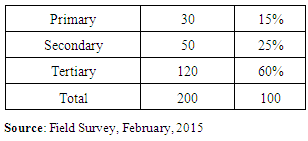

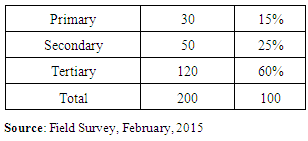

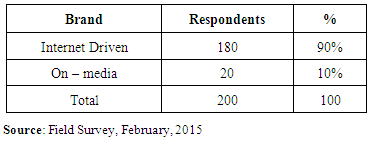

Table 1. Educational Qualification

|

|

|

|

|

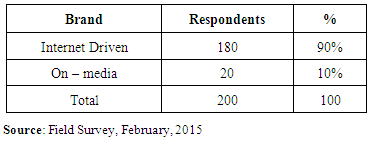

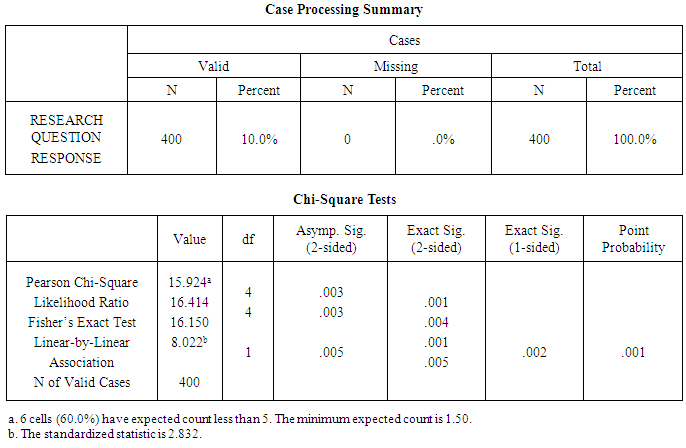

Table 2. Type of Phone Used

|

|

|

|

|

5. Summary, Conclusions and Recommendations

References

| [1] | McConnel, C.R and Brue, C.L (1999) Economics: Principles, Problems and Policies Irwin McCraw-Hill USA. |

| [2] | Abiraj, B.M.C (1998) Higher Level Business and Economics for Caribbean Students Arnold Publishers Great Britain. |

| [3] | Miller, R.L (1996) Economics Today Harper Collins College Publishers New York. |

| [4] | Adekanye, F. (1983) The Elements of Banking in Nigeria F&A Publishers Ltd Lagos. |

| [5] | The Central Bank of Nigeria, (Cash-less Nigeria). Available at https://www.cenbank.org/cashless/ last visited on 6th of June 2015. |

| [6] | Hetzel,

R.L (1993) A Quantity Theory Framework for Monetary Policy Federal

Reserve Bank of Richmond Economic Quarterly Volume 7913 Summer 1993

www.google.com retrieved 20/2/2015. |

| [7] | Reem

Heakal, “what is the quantity theory of money”. Available

athttps://www.investopedia.com/articles/05/010705.asp last visited on

06/06/2015. |

| [8] | Folarin, F. (2014) Cashless Policy and Online Shopping: Matter Arising Sundiata Post www.google.com retrieved 20/2/2015. |

| [9] | Oginni,

S.O., El-Maudie, J. Gambo, M. Abba and M.E. Onuh (2013) Electronic

Payment System and Economic Growth. A Review of Transition to Cashless

Economy in Nigeria International Journal of Scientific Engineering and

Technology Volume No 2 Issue No 9 pp 903-913 ISSN:2277-1581

www.google.com retrieved 20/2/2015. |

| [10] | Waithaka

James Mwangi 2015, “The effect of GDP Re-basing in Kenya”. A

publication of the School of Economics, University of Nairobi. Available

at

https://www.researchgate.net/publication/274634051_THE_EFFECT_OF_GDP_RE_BASING_IN_kENYA

last visited on 06/06/2015. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML

About Blogindoor

About Blogindoor

No comments:

Post a Comment